- Get link

- X

- Other Apps

Find answers to frequently asked questions about filing a 1099-MISC form using Intuit Online Payroll E-File service.

Important: Be sure to e-file before January 31, 2020.

As of January 1, 2019, you can use the 1099 E-file service to file 1099-MISC Forms only. Other 1099 forms are not currently supported. We walk you through the steps below.

How do I set up the 1099 service?

Here's how to add the 1099 service:

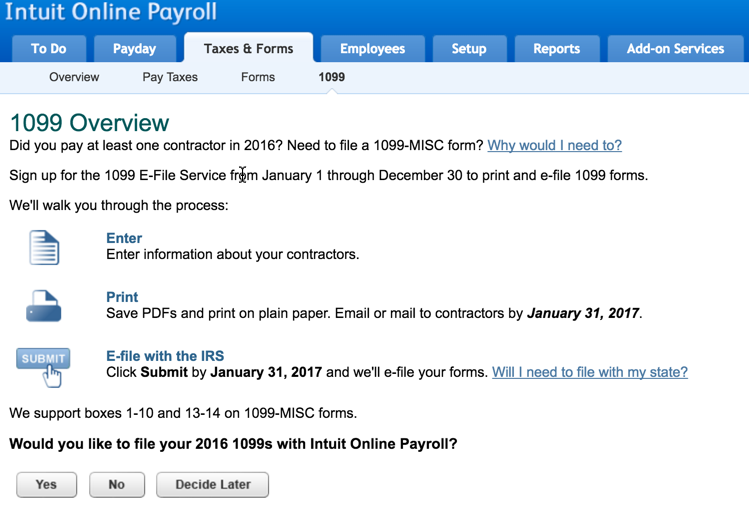

- On the Intuit Online Payroll screen select Taxes & Forms and then 1099.

- During the 1099 filing season (January 1 to April 30), there will be an item on your To Do tab for adding the 1099 service.

- After the 1099 service is added, the To Do item changes to an access point for returning to the 1099 service.

- And starting 10 days before the e-file deadline, if e-filing has not been completed, a warning message is added.

- When the 1099 service has not yet been added for the current filing year, the menu and the To Do item are added to the bottom of the page with Yes, No and Decide Later buttons:

- Select Yes to add the 1099 service.

- Select No to remove the 1099 To Do item.

- Select Decide Later to keep everything as is and return to the To Do page.

Set up 1099 service for Contractor Payments

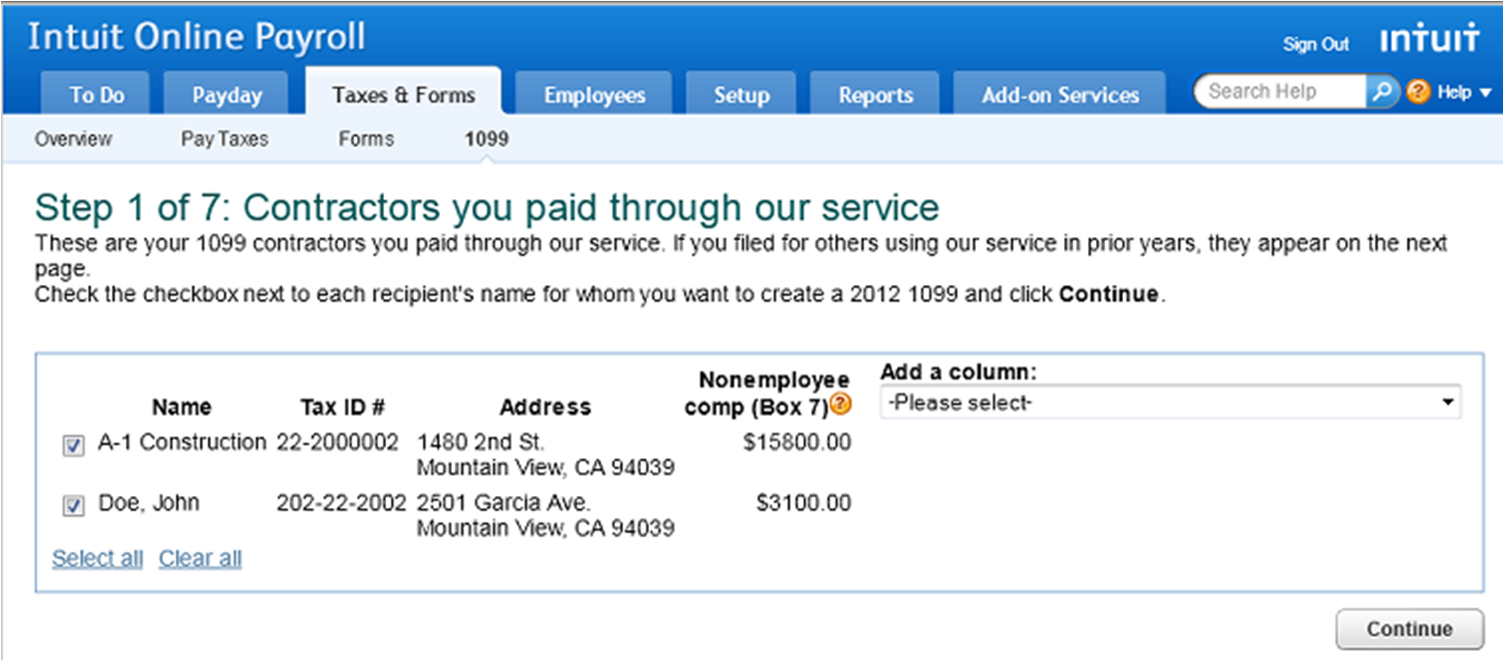

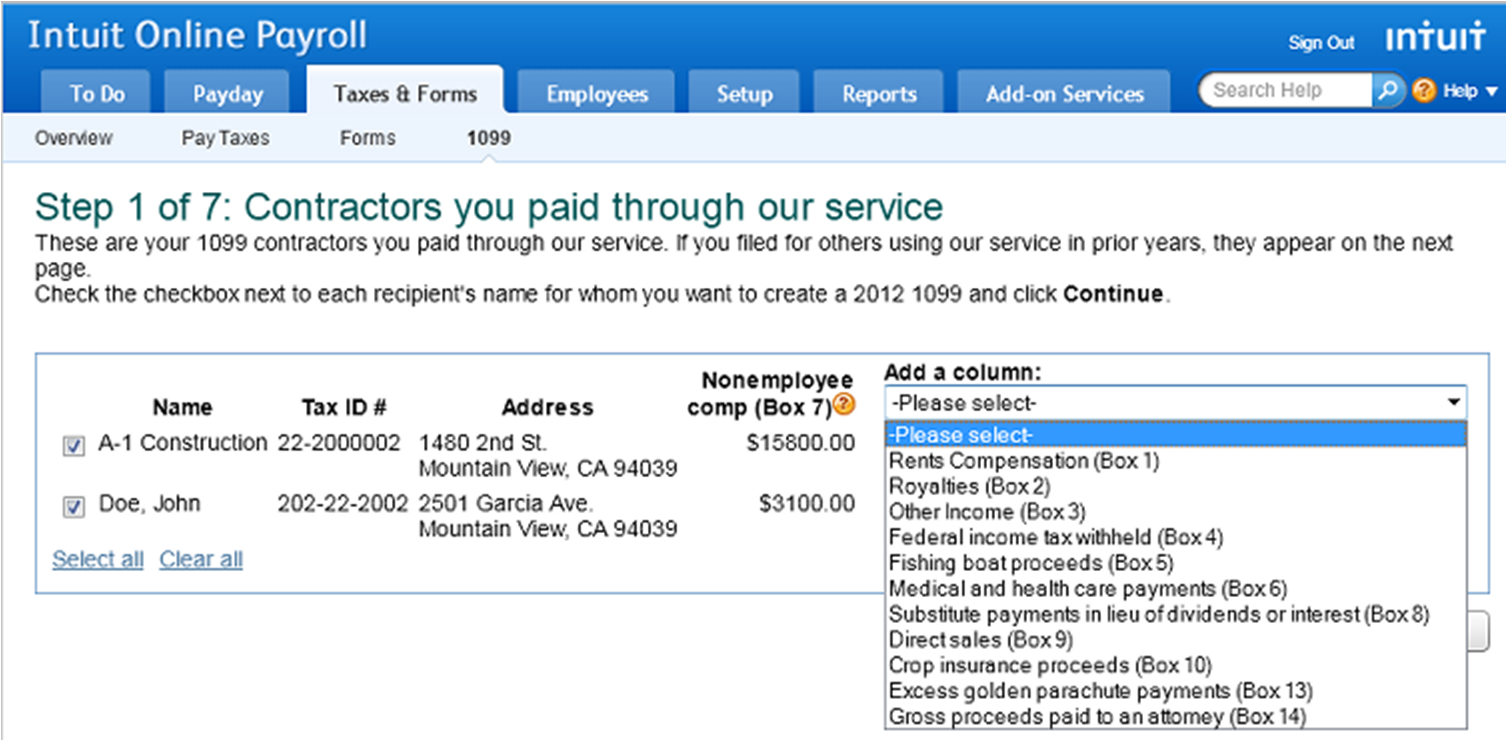

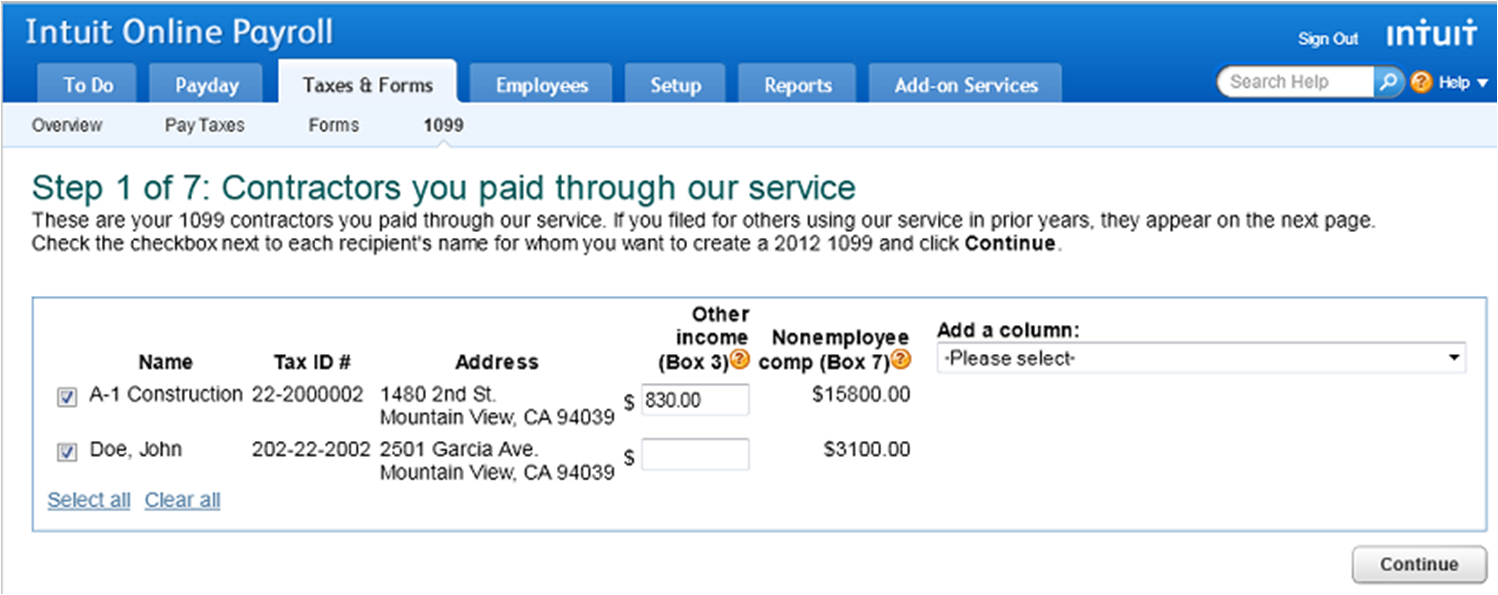

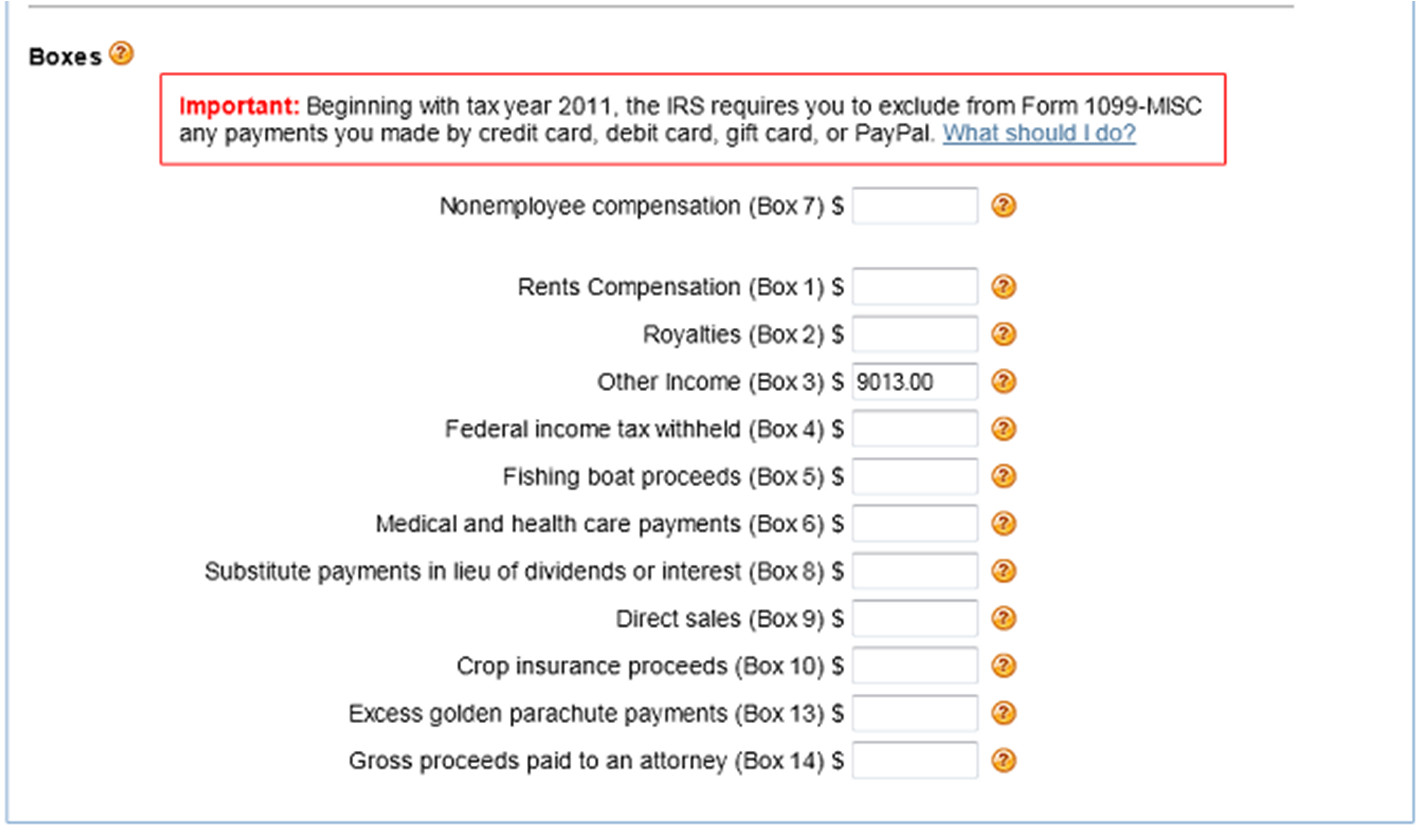

- If contractors were paid with Intuit Online Payroll in the previous year, those contractors can be selected for 1099 e-filing. Amounts paid through IOP are automatically recorded as 1099 Box 7 amounts.

- The drop-down menu can be used to add entry fields for other 1099 boxes.

- Additional amounts can then be entered for the added 1099 boxes.

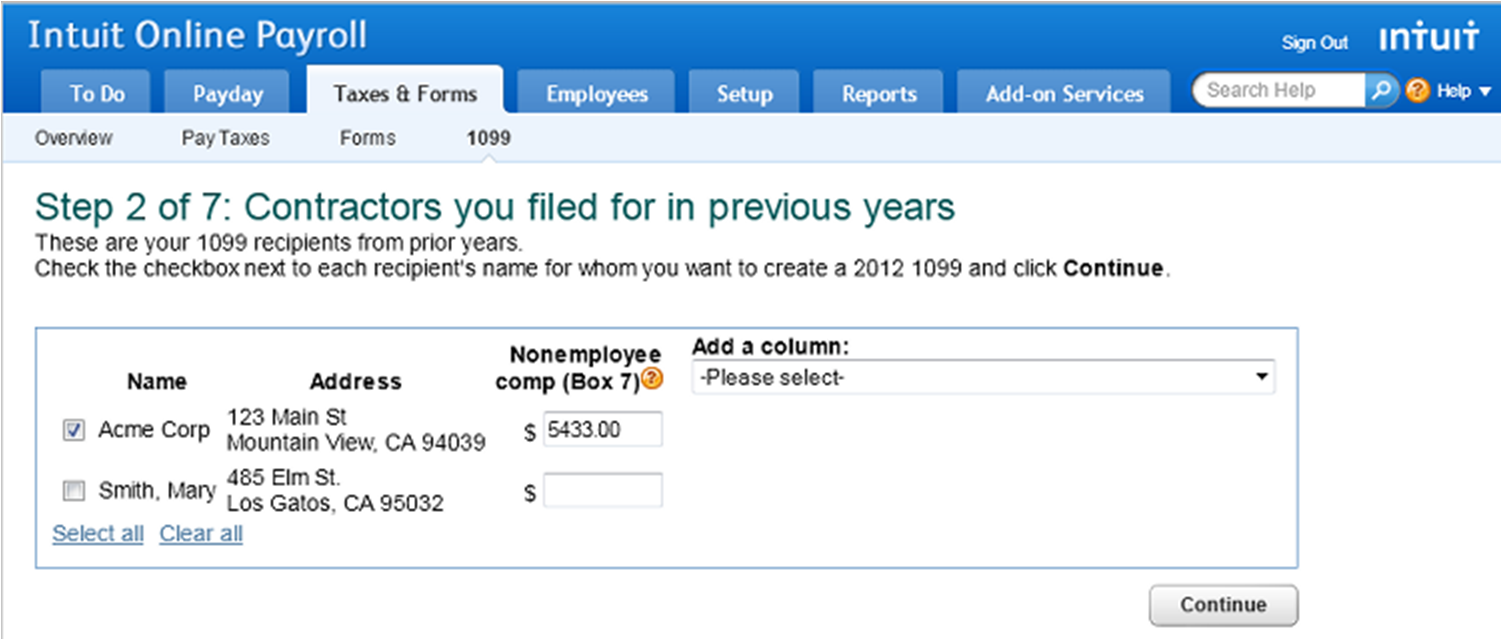

- If you used the 1099 E-File Service last year, the contractors can be selected for this year. Additional 1099 boxes can be added and amounts entered as described in step 1.

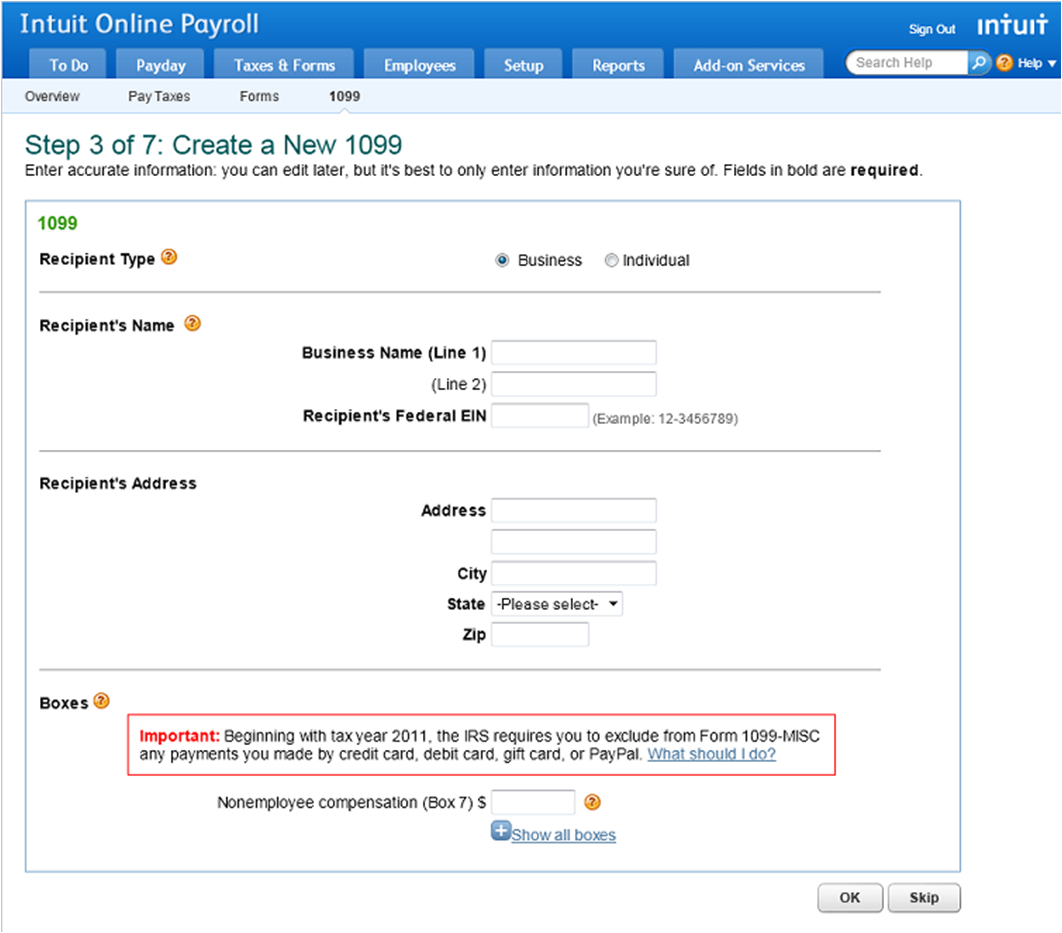

- The following list displays the contractors added from IOP contractor payments and the previous year's e-filing. Use the Edit links to modify or delete contractors. Select Add to add new contractors for this filing year.

Note:

|

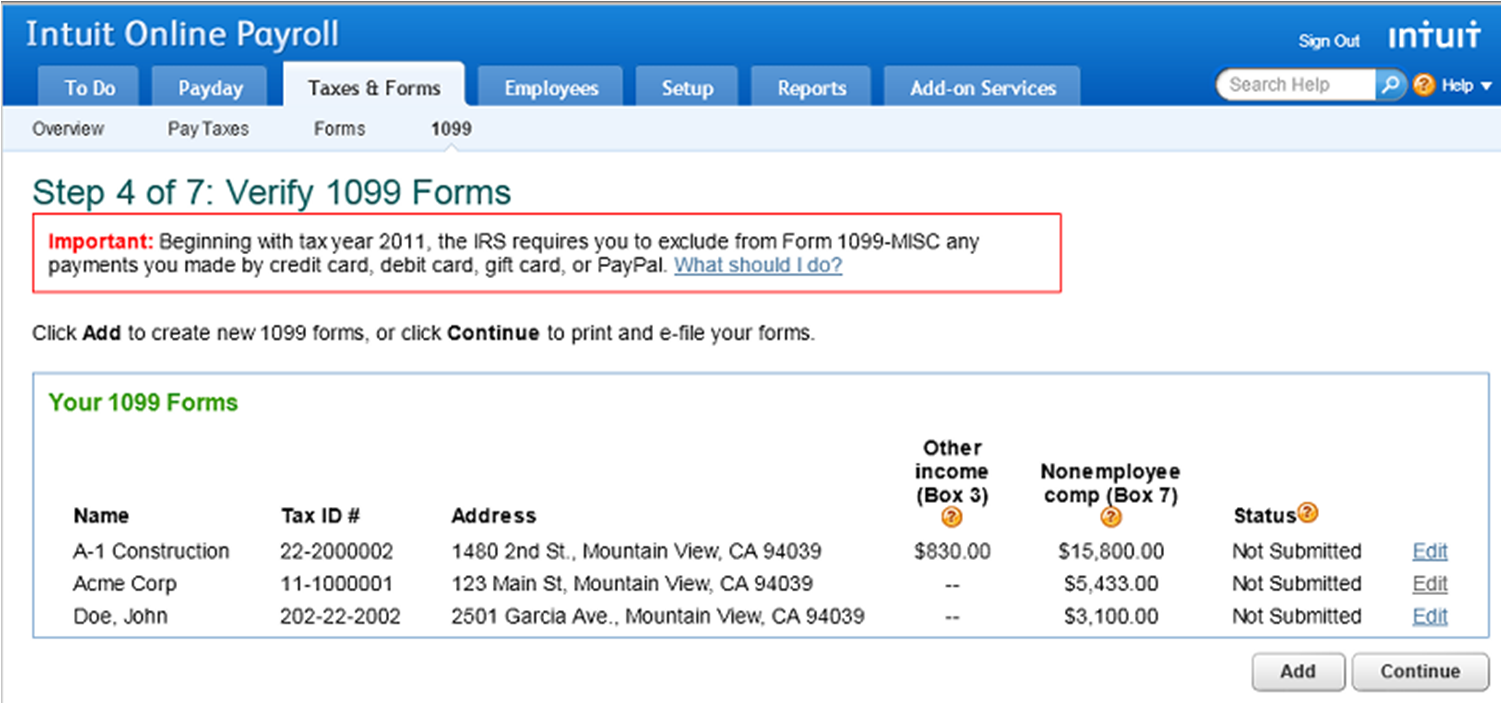

- Select the Show all boxes link to show all supported 1099 boxes.

- As each contractor is entered, the forms list is displayed to show all current 1099 data.

- For forms that have not yet been submitted for e-filing, the contractor can be edited or deleted by selecting Edit. At any point, even after submitting forms, you can return and e-file additional contractors.

How do I E-file and print a form?

Here are the steps to print and e-file:

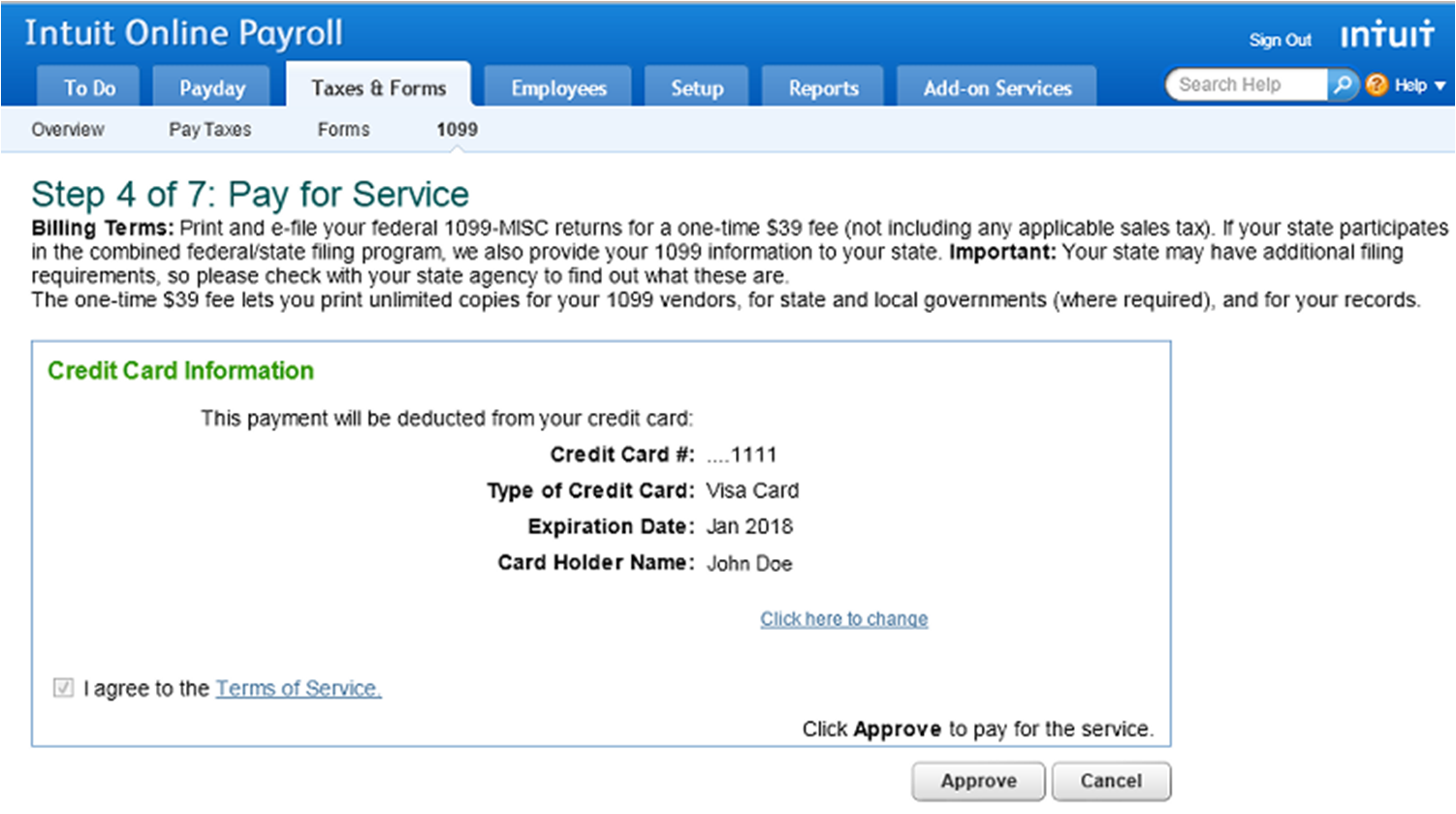

- Before you can print and e-file, you must enter and approve a credit card for billing. By default, the current credit card information for Intuit Online Payroll is used.

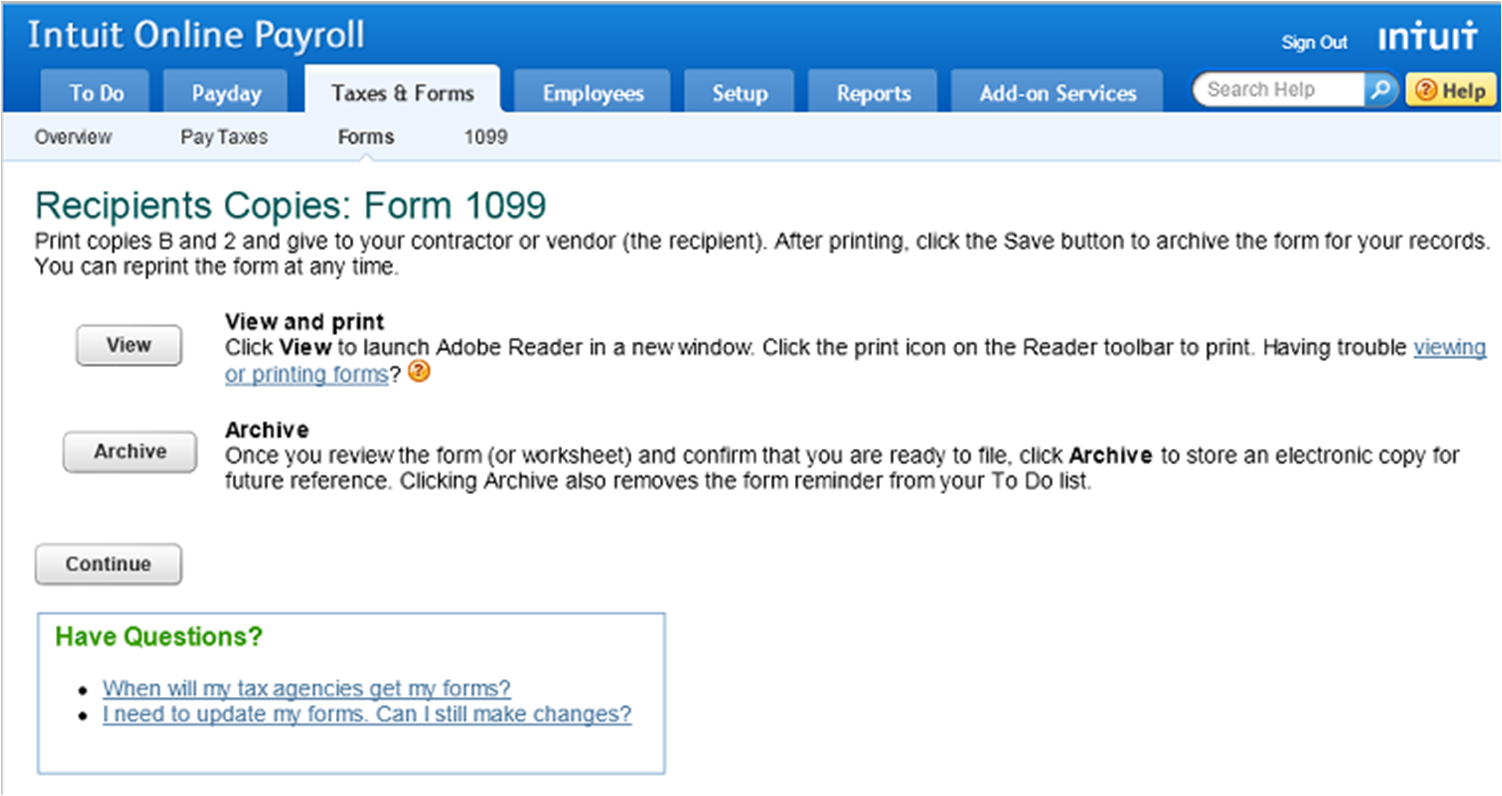

- Select the Print buttons to view and print 1099 forms. If you want to get a printout of 1099 information, select Printer-friendly Version of List. Select Continue when finished.

- Select View to display a printable PDF window with the 1099 forms. You can also select Archive to save a copy that can be printed later. Select Continue to return to the previous page.

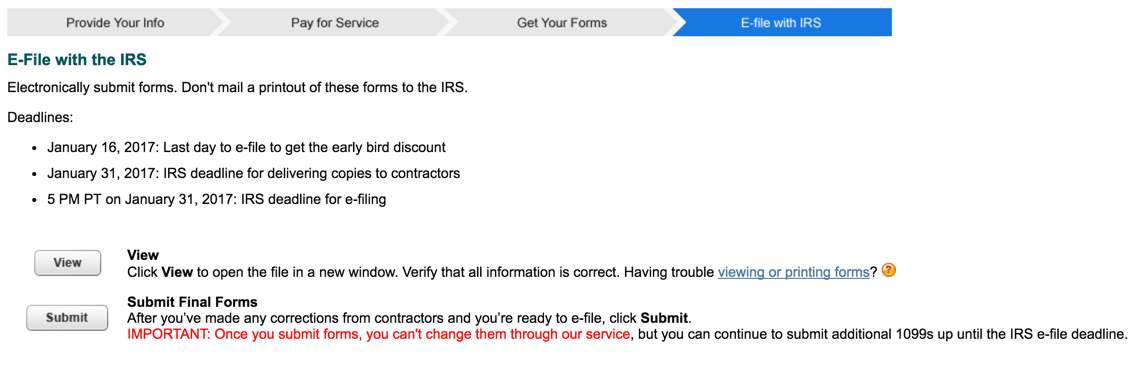

- Select View to view and print the 1099 forms that will be e-filed with the IRS. To queue the forms for electronic transmittal to the IRS, select Submit. (The transmittals are done in batches during the 1099 filing season.) Data cannot be modified for forms that have been submitted. However, if they haven't yet been transmitted, care support can delete the filing. Deleting the submission will allow you to make modifications and resubmit your forms.

( Warning: The paper version of Copy A of Form 1099 is for your records only. Don't print or mail this form to the IRS.)

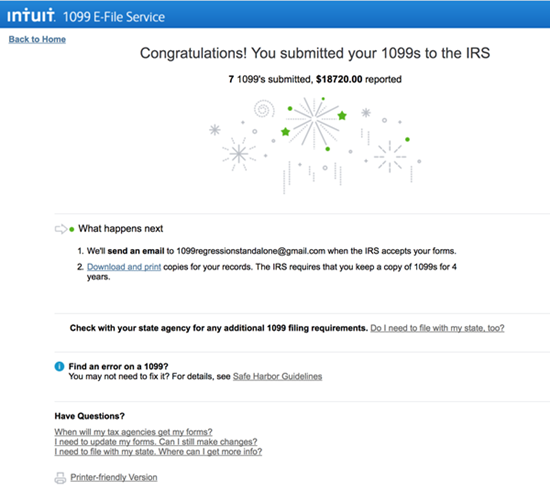

( Warning: The paper version of Copy A of Form 1099 is for your records only. Don't print or mail this form to the IRS.) - The submission confirmation page will appear once you submit your 1099 forms.

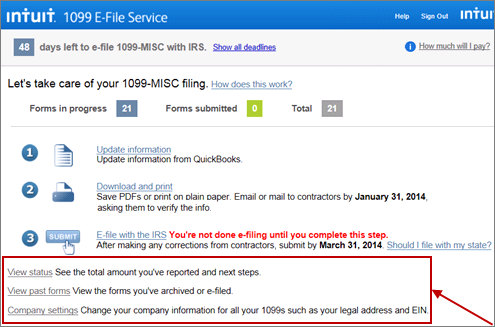

- The 1099 E-File home page has links under the E-File with the IRS link that will let you carry out different tasks.

View status

View past forms

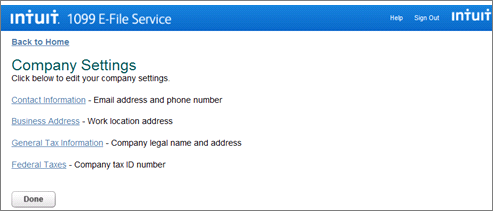

Company setting

I need help troubleshooting

Your business name is too long to fit into the box or it may appear twice on Form 1099.

Business name does not fit in the box

Your business name may not fit on the printed version of Form 1099 because it's too long. You do not need to be concerned about this or take any special action. The electronically submitted version of the form will contain the full business name. To ensure that the IRS receives the electronic transmittal with the correct filing name, you should not abbreviate your business name to fit on the printed 1099s.

Business name appears twice

If your business name and filing name don't exactly match, both names will be printed on Form 1099. This will occur even if the difference is seemingly minor, such as different spacing or capitalization. To resolve it, you should generally change your business name. In Online Payroll, go to Setup, then Contact Information.

You should only change your filing name if it's incorrect (according to IRS records). In Online Payroll, go to Setup, then General Tax Information. (Note: Changing the filing name will deactivate your federal electronic services. if you use e-services in your payroll account.)

When signing in to Intuit App Center, it gives you a warning message: "The user ID or password is incorrect".

If you're not sure if you have an Intuit Account or the application says there is already an Intuit Account with your email address, use the Forgot User ID application. The Forgot User ID application retrieves any Intuit Account user IDs associated with the email address.

If you don't remember the password set for your Intuit Account user ID, use the Forgot Password application to reset it. If you don't know the answer to the security question, contact support at 1.800.450.8475

I have paid my contractor more than the amount showing in my Intuit Online Payroll account, how can I increase the amount in Box 7?

The contractor payments created in your Intuit Online Payroll flow in Box 7 of form 1099-MISC. Since Box 7 can't be edited in the 1099 flow, you can add one or more additional manual payments to increase the amount in Box 7.

Here's what you need to do:

- Change the contractor's payment method from DD to manual (if applicable).

- Go to Payday.

- Select the contractor and enter the additional amount that needs to be shown in Box 7.

- Select Create Paychecks, then Approve Paychecks.

- Go to Taxes & Forms, then 1099 and confirm if the amounts in Box 7 is showing correct.

- You can change the contractor's payment method back to direct deposit if applicable).

When accessing the 1099 E-file service from QuickBooks, you receive one of the two following warning messages:

- One of the vendors we brought over from QuickBooks has different information than what you e-filed. If you need to file an amended 1099 form for this vendor, you must file an amendment manually; you cannot amend your e-filed forms through the 1099 E-File Service.

- (xx) vendors we brought over from QuickBooks have different information than what you e-filed. If you need to file an amended 1099 form for these vendors, you must file an amendment manually; you cannot amend your e-filed forms through the 1099 E-File Service.

Which is then followed by:

- XYZ Company: change to Tax ID

- XYZ Company: change to Name

- XYZ Company: change to Street address

- XYZ Company: change to City

- XYZ Company: change to State

- XYZ Company: change to Zip

- XYZ Company: change to box amounts

- XYZ Company: deleted from QuickBooks, no longer marked as eligible for 1099, or amount no longer meets threshold for 1099 filing

Solutions:

- The 1099 E-file service cannot be used to file amended 1099 forms. If you make changes to a vendor after the 1099 has been e-filed for that vendor, the 1099 E-file service will display a warning to notify you that amendments must be filed manually. This warning will be displayed each time you access the 1099 E-file service.

- Vendors whose 1099 forms have not yet been e-filed can continue to be e-filed normally. Changes made in QuickBooks for these vendors will be uploaded to the 1099 E-file service and will be reflected when the 1099s are e-filed.

You have reported an incorrect payer name and/or tax identification number (TIN) on one or more of the Forms 1099-MISC you filed with the IRS.

Intuit doesn't support corrections to Forms 1099-MISC. You're responsible for handling any errors to a recipient's 1099 form that has already been reported:

- Provide the recipient with a corrected form.

- Prepare and file the applicable corrected forms to the IRS and state tax agency.

The IRS General Instructions for Certain Information Returns (Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G) contain the information you'll need to prepare and file corrected 1099-MISC forms. Depending on the error, refer to the appropriate section of the document:

- Incorrect payer name and/or TIN: Section F (Electronic Reporting), subsection "Reporting incorrect payer name and/or TIN"

- Duplicate reporting or a large percentage of incorrect information: Section F (Electronic Reporting), subsection "Reporting incorrect payer name and/or TIN

- Other errors: Section H (Corrected Returns on Paper Forms), and error chart on the page following the end of Section H

What does the 1099 E-File Service cost?

The service starts at $14.99 and includes creation and e-filing of up to three 1099-MISC forms. After three forms, the price is $3.99 for each additional form. If you have more than 20 forms, we'll include them at no additional charge.

(In early January, we offer an early bird discount starting at $12.99 for the first three forms and $2.99 for each additional form).

What are the key 1099 deadlines?

The key 1099 deadlines are:

- January 1: The 1099 E-File Service opens

- January 31: Deadline for providing contractors with 1099-MISC copies

- January 31: IRS deadline for submitting paper 1099-MISC forms (does not apply to e-filers)

- January 31 at 5:00 pm PST: IRS deadline for e-filing 1099-MISC forms

How do I get copies to my contractors?

The Intuit 1099 E-File Service creates PDF copies of all your forms. Once completed, you can email them or print and mail them to your contractors.

How is my copy sent to the IRS?

We are an approved IRS e-file provider, and we will transmit the form securely and electronically for you.

What if I use QuickBooks? Can I bring over my data?

QuickBooks Online Simple Start, Essentials, and Plus users can prepare 1099s. If you use QuickBooks Desktop, see 1099 E-File: QuickBooks Desktop setup, troubleshooting, & FAQs for more details.

What if I use Intuit Online Payroll?

If you pay your contractors through Intuit Online Payroll, go to Taxes & Forms, then 1099 after January 1 to get started on your 1099 e-filing. Your data imports automatically.

As an accountant, can I file for multiple clients?

Accountants who use Intuit Online Payroll for Accounting Professionals can file for multiple clients at the discounted price of $15 per client. This includes unlimited 1099-MISC forms for each client on the Online Payroll service. In addition to filing for current payroll clients, accountants can add "1099-only" clients during the tax filing season.

Which types of 1099 forms and boxes are supported?

This service is only for preparing 1099-MISC forms. We support boxes 1-14.

What about state forms?

See if you need to file or if your state requires you to file.

What about the 1096?

The 1096 is not required when you e-file. One less piece of paper!

Don't I need to buy those special preprinted forms with the red ink?

E-filing's advantage is you have an option to send your forms electronically or print on plain paper.

Comments

Post a Comment