- Get link

- X

- Other Apps

1099 E-File Service FAQs

The Intuit 1099 E-File service makes it easy for small businesses to file 1099s electronically in minutes. Here are answers to some frequently asked questions you may have about it.

Where can I find information about important dates?

For information about important dates, see Intuit 1099 E-File Service - FAQs.

How do I sign up for 1099 E-File?

- For Intuit Online Payroll,see 1099 E-File Service: Intuit Online Payroll setup, troubleshooting, & FAQs

- For QuickBooks Online, see 1099 E-File Service: QuickBooks Online setup, troubleshooting, & FAQs

- For the 1099 E-File Service Standalone Account, see 1099 E-File Service: Standalone Account setup, troubleshooting, & FAQs

You may be asked to validate your Intuit account when signing in.

Using QuickBooks Desktop? See 1099 E-File: QuickBooks Desktop setup, troubleshooting, & FAQs

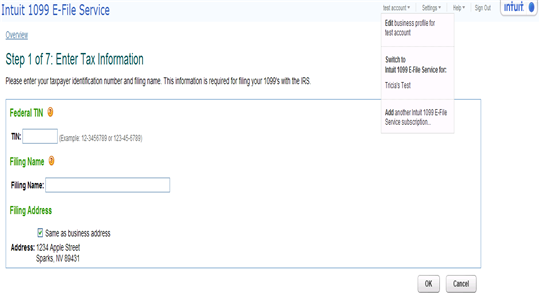

How do I sign up and file for multiple filing companies?

Once you have logged into the Intuit 1099 E-File Service you will see the last company you filed for on the Toolbar. Select the drop down and then "Add another Intuit 1099 E-File Service Subscription. This will give you a page to begin entering the next company's information.

| Note: Each subscription for each company is a separate fee. |

How do I pay for the 1099 E-File?

Billing or payment method for the 1099 E-File service is by credit card. You will be prompted to enter your billing information in the process of e-filing your forms, and approve each payment. Every payment approved will show as a separate charge on your bank/account statement, and will not be combined as one charge.

| Note: Intuit Online Payroll customers can pay for service via ACH direct debit if using the same checking account used to pay for their payroll service. |

How much does the 1099 E-file service cost?

For information on pricing, see Intuit 1099 E-File Service - Pricing.

What contractors does the 1099 E-File service support?

The 1099 E-File Service supports contractors with addresses in the 50 states. It does not currently allow e-file for contractors with a U.S. Territories or Foreign Address.

If you use QuickBooks Online and want more information, please see the FAQs & Troubleshooting section of 1099 E-File Service: QuickBooks Online setup, troubleshooting, & FAQs

Do I still have to print my 1099s to give to the contractors or vendors, and where do I get 1099 paper?

E-filing your 1099s does not replace the IRS requirement of providing 1099s to your recipients (contractors or vendors). If you are using the Intuit 1099 E-File Service, you can download and email (or print and mail on plain paper) your 1099 forms to contractors.

| Note: If you use QuickBooks Online, Intuit will send online and printed copies to your contractors after you e-file. Visit the 1099 E-File Service: QuickBooks Online setup, troubleshooting, & FAQs for more information. |

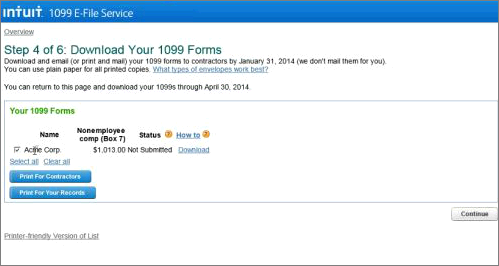

How do I check the status of my filing?

You may return to your 1099 E-File account here and verify the status.

Below are the list of statuses and what they mean:

- Not Submitted: You have not e-filed Form 1099-MISC with the IRS. You can continue revising it.

- Submitted: You have e-filed the form to the IRS. (If you need to revise it, you may need to file a manual amendment. Please use the IRS instructions and form.)

- Received by IRS: The IRS has received your form and is either processing it or has already processed and approved it. Customers who have submitted their 1099 E-File forms will receive a confirmation email approximately a week after the IRS accepts and confirms submissions. You many not receive this confirmation until the middle of January or later.

Can I access archived/previously filed forms?

Yes. You can access archived or previously filed 1099 forms that are from January 1 through April 30 at any time by logging into your 1099 E-File Service account here.

We recommend downloading or printing copies of your 1099s for your records during the "Download Your 1099 Forms" step as shown below:

Can I submit additional 1099s even after e-filing?

Yes. You can add contractors and submit another batch of 1099 forms. Each transmission or batch will be charged separately to your account.

What is a 1099-Misc form?

The 1099-Misc form is used to report payments made to contractors, such as vendors, contractors, landlords, attorneys, etc. The IRS has specific rules for determining if a worker is an employee or an independent contractor.

For assistance in classifying your workers, visit www.irs.gov and search for Publication 15.

Do I need to file the 1099-Misc form?

An organization that pays independent contractors must file two forms at the end of each tax year:

- 1099-Misc: The contractor version of the employee's W-2. Reports all wages or payments delivered for the entire year. One 1099-MISC form is sent to each contractor who was paid $600 or more during the year.

- 1096: The single transmittal form the payer sends to the IRS. Reports all payments made to all contractors. For example, if a payer sends out fifteen 1099s for the year, the information from all fifteen 1099-Misc forms is captured onto the single 1096.

Because our customers file electronically, they are not required to file form 1096. For assistance in determining whether you need to file this form, visit www.irs.gov and search for Publication 15.

What boxes on 1099-Misc form are supported by 1099 E-File?

1099 E-File supports:

- Boxes 1 to 10

- Boxes 13 and 14

The following boxes are NOT supported:

- Boxes 11 and 12

- Boxes 15 to 18

Here are 1099-Misc form specific instructions and box definitions.

Can I update a Form 1099-MISC after submitting it?

After you submit a Form 1099-MISC, you cannot update it through your Payroll product. Instead, you'll need to file a manual amendment. Make sure before you e-file a form that all the information is correct.

How do I file a manual amendment after I e-file my 1099-MISC form?

- Order 1099-MISC IRS forms online at IRS Online Ordering for Information Returns and Employer Returns or over the phone.

- Fill out the 1099-MISC form and be sure to select the Corrected checkbox.

- Mail the form to the IRS.

- Mail the recipient copy to your contractor as soon as possible so that they can file their taxes.

Can I manually file my 1099-Misc form?

We don't support manual filing of 1099-Misc forms to the IRS. In particular, we don't provide submittable paper for 1099 Copy A and 1096 forms.

| Note: While the IRS only mandates e-filing for 250 or more 1099s, the fact that we always e-file the forms provides greater convenience and reduces errors. |

Do I need to file Form 1099-MISC with my state?

You're not required to file Form 1099-MISC with your state if your business is in:

- Alaska (AK)

- Florida (FL)

- Iowa (IA)

- Illinois (IL)

- New Hampshire (NH)

- Nevada (NV)

- New York (NY)

- South Dakota (SD)

- Tennessee (TN)

- Texas (TX)

- Washington (WA)

- Wyoming (WY)

For all other states, check with your state agency for filing requirements. We do not file 1099s with the states for you.

How do I find out more information about IRS regulations for Form 1099-MISC?

Intuit has a variety of solutions to assist you with revised IRS regulations. See IRS Reporting Requirements for Third Party Vendor Payments for more information.

Is my data secure?

Yes. You entrust us to protect sensitive data and we take that seriously. Our customers' privacy and security is job one. When Intuit transmits 1099s, we comply with all IRS requirements in Publication 1220.

Comments

Post a Comment